The imposition of a 25% tariff by the Trump administration on Canadian softwood lumber has created a seismic shift in the U.S. construction and design industries. As the U.S. seeks alternative suppliers to offset rising costs, Brazilian exporters find themselves uniquely positioned to capitalize on this opportunity. With abundant forest resources, competitive pricing, and a growing reputation for sustainable practices, Brazil could emerge as a key player in the American lumber market.This article explores how Brazilian exporters can benefit from these tariffs, focusing on opportunities for architects, interior designers, builders, and eco-conscious clients to embrace Brazilian wood products as viable alternatives.

The Context: Why Canadian Lumber Tariffs Matter

Softwood lumber is a cornerstone of the U.S. construction industry, widely used in framing, flooring, cabinetry, and furniture. Historically, Canada has been the dominant supplier of softwood lumber to the U.S., delivering approximately 28 million cubic meters annually. However, the newly imposed tariffs are expected to significantly increase the cost of Canadian imports, disrupting supply chains and driving up prices for builders and designers.This disruption creates a gap in the market that Brazilian exporters are well-positioned to fill. Brazil already exports significant volumes of wood products to the U.S., including plywood, sawnwood, and fiberboard. With its competitive advantages in cost and sustainability, Brazil could become a preferred alternative supplier for American businesses.

Key Benefits for Brazilian Exporters

1. Increased Market Demand

The tariffs on Canadian lumber are likely to prompt U.S. buyers to seek alternative suppliers to avoid higher costs. Brazil’s existing trade relationships with the U.S., coupled with its ability to scale up production, make it an attractive option.

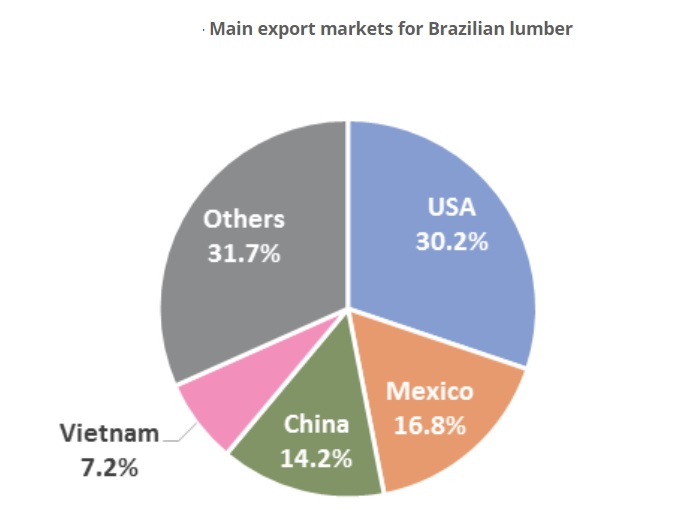

- Market Potential: In 2024, Brazil exported $126 million worth of timber to the U.S., making it the largest destination for Brazilian wood products. This figure is expected to grow as demand shifts away from Canada.

- Diversification: While Brazilian plywood exports to the U.S. declined slightly in recent years due to certification issues, this new market dynamic offers an opportunity for recovery and expansion.

2. Competitive Pricing

Brazil’s low-cost production model is one of its strongest advantages. The country benefits from:

- Fast-Growing Pine Plantations: Brazil’s climate allows for rapid growth cycles of softwoods like pine, reducing production costs compared to Canada or Europe.

- Currency Advantage: A favorable exchange rate often makes Brazilian wood products more affordable for U.S. buyers.

With Canadian lumber now subject to a 25% tariff, Brazilian exporters can offer competitive pricing that appeals to cost-sensitive builders and designers.

3. Sustainability Appeal

As sustainability becomes a top priority for architects and eco-conscious clients, Brazil’s commitment to sustainable forestry practices is a significant selling point.

- Certifications: Many Brazilian exporters hold certifications such as FSC (Forest Stewardship Council), which ensure responsible forest management.

- Green Technologies: Investments in eco-friendly production methods further enhance Brazil’s reputation as a sustainable supplier.

By promoting these credentials, Brazilian exporters can attract environmentally conscious buyers who are looking for alternatives to traditional sources.

4. Product Diversity

Brazil offers a wide range of wood products that cater to various needs within the construction and design industries:

| Product | Applications | Export Value (April 2024) |

|---|---|---|

| Plywood | Structural panels, cabinetry | $154 million |

| Sawnwood | Flooring, furniture | $50 million |

| Fiberboard | Wall panels, furniture backing | $30 million |

This diversity allows architects and builders to source multiple materials from a single supplier, simplifying procurement processes.

5. Strengthened Trade Relationships

The current trade environment provides an opportunity for Brazilian exporters to deepen their relationships with U.S. buyers:

- Long-Term Contracts: As U.S. companies pivot away from Canadian suppliers, they may seek stable partnerships with Brazilian producers.

- Market Penetration: Although Brazil currently supplies only about 1% of the total U.S. softwood market, this figure could grow significantly with strategic marketing efforts.

Opportunities for Architects, Designers, and Builders

The shift toward Brazilian wood products presents unique opportunities for professionals in architecture and construction:

For Architects and Designers

- Unique Aesthetics: Incorporating tropical hardwoods or sustainably sourced pine can add distinctive textures and colors to projects.

- Eco-Friendly Branding: Promoting the use of FSC-certified materials aligns with growing client demand for green building practices.

For Builders

- Cost Savings: Competitive pricing on Brazilian lumber can help offset rising costs associated with Canadian tariffs.

- Supply Chain Stability: Establishing relationships with Brazilian suppliers ensures access to high-quality materials without tariff-related price fluctuations.

Challenges and Solutions

While the opportunities are significant, there are challenges that Brazilian exporters must address:

1. Certification Issues

In 2022, certification problems led to a decline in Brazilian plywood exports. To regain trust:

- Exporters must ensure compliance with U.S. structural standards.

- Investments in third-party verification can enhance credibility.

2. Shipping Constraints

Shipping delays have occasionally impacted export volumes6. Solutions include:

- Partnering with reliable logistics providers.

- Diversifying shipping routes to mitigate disruptions.

Marketing Strategies for Brazilian Exporters

To fully capitalize on this opportunity, Brazilian exporters should adopt targeted marketing strategies:

1. Highlight Sustainability

Positioning Brazilian wood as an eco-friendly alternative can resonate strongly with architects and eco-conscious clients.

2. Showcase Versatility

Demonstrate how different wood products meet diverse needs within construction and design.

3. Build Trust

Address past certification issues transparently while emphasizing improvements in quality control.

Conclusion

The tariffs on Canadian softwood lumber have created a rare opportunity for Brazilian exporters to expand their footprint in the U.S. market. With competitive pricing, sustainable practices, and diverse product offerings, Brazil is well-positioned to meet growing demand from American builders and designers.For architects seeking unique materials or builders looking for cost-effective solutions, now is the time to explore what Brazil has to offer. By embracing this shift in global trade dynamics, both suppliers and buyers can create lasting partnerships that drive innovation and sustainability in construction projects worldwide.