As of February 1, 2025, the landscape of the U.S. lumber market is undergoing significant changes due to the imposition of a 25% tariff on Canadian softwood lumber. This decision, driven by trade policy under the Trump administration, has far-reaching implications for various stakeholders in the construction and design industries. Among those poised to benefit from this shift are Brazilian exporters of softwood lumber, who may find new opportunities in a market that is increasingly looking for alternatives to Canadian products.This article will explore how these tariffs might affect the pricing and availability of Brazilian softwood lumber in the U.S., while also considering the perspectives of architects, interior designers, builders, and eco-conscious clients.

Understanding the Current Market Dynamics

The Role of Canadian Softwood Lumber

Canada has long been a dominant supplier of softwood lumber to the United States, accounting for approximately 30% of U.S. consumption. In 2023 alone, Canada exported about 28.1 million cubic meters of softwood lumber to the U.S., primarily used in residential and commercial construction. The introduction of tariffs is expected to disrupt this supply chain, leading to increased prices for Canadian lumber and prompting U.S. companies to seek alternative sources.

The Impact of Tariffs

The 25% tariff on Canadian softwood lumber is designed to protect domestic producers by making imported Canadian lumber significantly more expensive. As U.S. companies face these increased costs, they will likely pass on some of these expenses to consumers, resulting in higher prices for building materials across the board. According to Rajan Parajuli, an associate professor at NC State University, tariffs tend to push domestic lumber prices higher, which can ultimately impact housing affordability and availability.

The Brazilian Advantage

Competitive Pricing

Brazilian exporters have an opportunity to fill the gap left by reduced Canadian imports. With competitive pricing structures, Brazilian softwood lumber can become an attractive alternative for U.S. buyers seeking to mitigate increased costs associated with tariffs on Canadian products.

- Lower Production Costs: Brazil benefits from lower production costs due to its abundant forest resources and favorable climate for growing fast-growing species like pine.

- Exchange Rate Benefits: A favorable exchange rate can further enhance Brazil's competitiveness in pricing compared to Canadian lumber.

Availability and Supply Chain Resilience

The tariffs create a pressing need for alternative sources of softwood lumber in the U.S., which Brazilian exporters are well-positioned to meet:

- Existing Trade Relationships: Brazil has established trade relationships with U.S. buyers that can be leveraged for increased exports.

- Capacity for Increased Production: Brazilian producers have the capacity to scale up production quickly in response to rising demand from the U.S., potentially offsetting declines in Canadian imports.

Market Trends Influencing Brazilian Lumber Exports

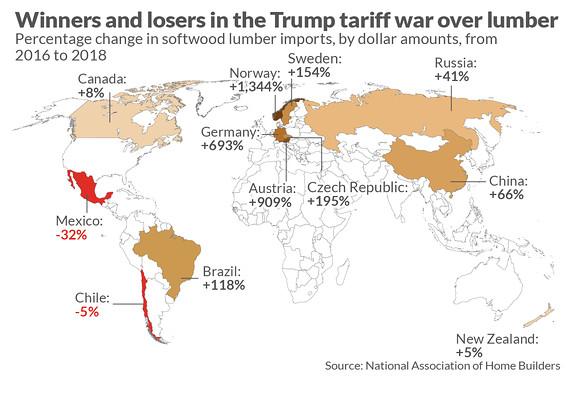

Shifts in Import Patterns

As U.S. companies adjust their sourcing strategies due to tariffs on Canadian lumber, we are likely to see shifts in import patterns:

- Increased Imports from Brazil: With Canadian imports becoming more costly, U.S. companies may turn to Brazil as a primary supplier.

- Diversification of Supply Sources: Companies may also look beyond Canada and Brazil toward other countries like Chile or Sweden; however, Brazil's existing infrastructure and trade relationships make it a more immediate option.

Competition from Other Suppliers

While Brazilian exporters stand to benefit from increased demand, they will also face competition from other international suppliers:

- Chilean Plywood Imports: Recent trends indicate a rise in plywood imports from Chile as U.S. buyers look for alternatives.

- European Suppliers: Countries like Germany and Sweden are also increasing their exports but lack the capacity to fully replace Canadian supplies.

Implications for Architects and Designers

Sourcing Sustainable Materials

As architects and designers increasingly prioritize sustainability in their projects, Brazilian softwood lumber can align with these values:

- Sustainable Forestry Practices: Many Brazilian exporters adhere to sustainable forestry practices that appeal to eco-conscious clients.

- Certifications: Certifications such as FSC (Forest Stewardship Council) can enhance the marketability of Brazilian wood products among environmentally aware consumers.

Design Opportunities

Brazilian wood species offer unique aesthetic qualities that can enrich architectural designs:

- Diverse Aesthetics: The variety of wood species available from Brazil allows designers to incorporate unique textures and colors into their projects.

- Versatile Applications: Brazilian softwoods can be used across various applications, including structural elements, cabinetry, flooring, and furniture.

Challenges Facing Brazilian Exporters

While there are significant opportunities for Brazilian exporters following the imposition of tariffs on Canadian lumber, challenges remain:

Certification Issues

In recent years, Brazilian plywood exports have faced challenges related to certification issues that have limited their market access:

- Regulatory Compliance: Ensuring compliance with U.S. regulations is essential for maintaining access to this lucrative market.

- Quality Assurance: Exporters must invest in quality assurance processes to meet stringent U.S. standards.

Shipping and Logistics

Logistical challenges can impact the timely delivery of Brazilian lumber products:

- Transportation Costs: Increased shipping costs can affect overall pricing competitiveness.

- Supply Chain Disruptions: Global supply chain disruptions can lead to delays that hinder timely delivery.

Conclusion

The imposition of tariffs on Canadian softwood lumber presents both challenges and opportunities within the U.S. market. For Brazilian exporters, this shift may lead to increased demand for their products as American builders and designers seek alternatives that align with rising costs associated with Canadian imports.By leveraging competitive pricing structures, sustainable practices, and existing trade relationships, Brazil stands poised to become a key player in meeting U.S. demand for softwood lumber. Architects, interior designers, builders, and eco-conscious clients should consider exploring what Brazilian wood products have to offer as they navigate this evolving landscape.As we move forward into 2025 and beyond, staying informed about global trade dynamics will be crucial for all stakeholders involved in construction and design. Embracing sustainable materials from reliable sources like Brazil not only supports business goals but also contributes positively toward environmental stewardship—an increasingly important consideration in today’s market.