Observing the historical evolution of exports in some of the main segments of the forest sector, we notice that trends for all of them, to varying degrees, point towards growth, both in value and volume.

This is the third article in a series that Forest2Market Brazil has been developing in recent weeks about exports in the Brazilian forest sector. Each article focuses on a specific segment of this sector. The first article covered the pulp segment, the second addressed plywood, and this third article will focus on the exports of sawn softwood timber.

Historical Analysis

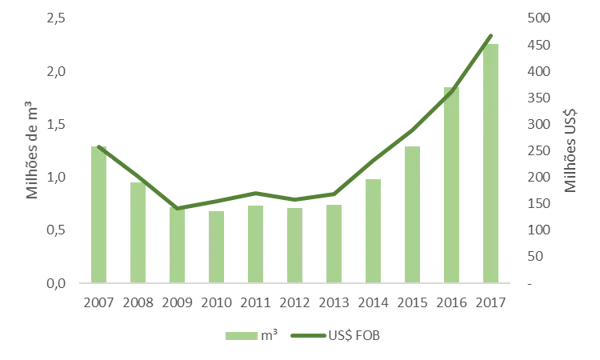

Starting from 2011, the post-international crisis period, the sawn softwood timber segment experienced an 82% growth (6.2% per year) in value and a 75% increase (5.7% per year) in volume, closing 2017 with $467 million in exports, surpassing the levels seen before the crisis (Figure 1).

Figure 1. Historical evolution of Brazilian exports of sawn softwood timber

Main Exporting States

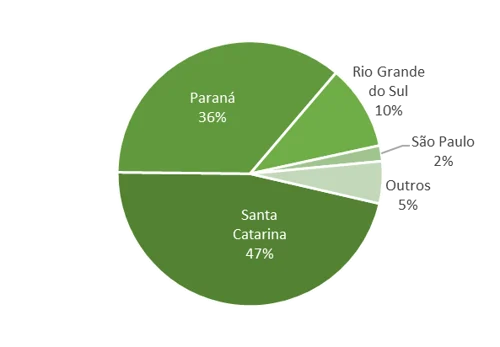

As observed in the analysis of the plywood market, there are two main exporting states for sawn timber: Paraná and Santa Catarina (Figure 2).

These states stand out due to the large number of sawmills they host, most of which use pine logs as raw material. It is worth noting that these states are also the leading regions in terms of planted pine areas in the country.

Figure 2. Main exporting states of sawn timber in 2017 (tons)

Destinations

The main destination for Brazilian sawn softwood timber in 2017 was the United States, which imported over 786,000 m³ of this product.

Unlike the reality in Brazil, sawn timber is a highly valued product in the United States' construction sector, as wood is an essential raw material for residential construction in the country.

Figure 3. Main destinations for Brazilian sawn softwood timber in 2017 (by volume)

Source: SECEX

What are the drivers of the growth in sawn timber exports?

As highlighted in the article on plywood, there are several reasons behind the significant recent increase in Brazilian sawn timber exports. Among them, the following stand out:

- Increased external demand, driven by the North American and European markets, directly linked to the construction industry;

- Favorable exchange rate;

- U.S. policies: Decisions by President Donald Trump indirectly influenced the demand for Brazilian sawn timber. One example is the imposition of tariffs on Canadian sawn timber.

Outlook

The expectation for the sawn timber industry is that the global market will continue to grow, fueled by economic recovery and the consequent expansion of the construction sector in countries like the United States, as well as the positive economic conditions in various European countries.

According to economists, the exchange rate is expected to remain high (above 3.8), favoring exports. However, since it is an election year, some caution is necessary, as the effects of both election rounds on exchange rate fluctuations need to be closely monitored.

The price of raw material (pine logs) is likely to continue rising, following the trend identified by Forest2Market Brazil. Sawn timber producers should monitor this growth to identify the right moment to adjust the final product price, thereby maintaining profit margins.